Key Takeaways

- Crypto KYC drop-off typically ranges from 50–80% of started verifications, driven by lengthy multi-step flows, poor mobile UX, and deep-rooted trust concerns about sharing identity data with centralized platforms.

- Implementing crypto-specific, risk-based KYC—rather than bank-style one-size-fits-all verification—is the fastest path to cutting abandonment while staying compliant with BSA, 6AMLD, and MiCA requirements.

- Embedding KYC natively inside your crypto app or wallet, minimizing redirects, and optimizing document capture on mobile can improve completion rates by double-digit percentages.

- Integrating fraud signals (device fingerprinting, IP reputation, wallet history) allows platforms to route low risk users through a fast lane while reserving enhanced checks for high risk cases, reducing both costs and unnecessary friction.

- Continuous measurement through step-level analytics, A/B testing, and cohort tracking is essential—teams should monitor drop-off by step and iterate monthly or quarterly to stay ahead of shifting user expectations.

Why Crypto KYC Has Such High Drop-Off Rates

Crypto onboarding is fundamentally more fragile than traditional fintech. You’re dealing with a global user base, highly mobile-first behavior, and a community with heightened skepticism about sharing personal data with centralized entities.

Industry benchmarks from 2023–2024 show that crypto KYC abandonment typically ranges between 50–80% for started-but-not-completed verifications. Even well-optimized exchanges report around 25% average drop-off, while platforms with clunky flows or emerging-market user bases see abandonment rates climb past 60%.

The key friction drivers include:

- Long multi-step flows that ask for more information than users expect upfront

- Repeated document submissions when initial uploads fail quality checks

- Failed selfie and liveness detection attempts due to poor lighting or camera quality

- Slow manual reviews that leave users waiting hours or days without feedback

- Unexpected additional requests like source of funds questionnaires that appear mid-flow

The trust deficit specific to crypto makes this worse. Users fear doxxing, exchange hacks, and tax reporting implications. When platforms provide unclear messaging about data use, storage practices, and retention periods, users quit mid-flow rather than risk exposure.

A typical crypto KYC funnel looks something like this:

- Sign up → 100% (baseline)

- Start KYC → 70-80% continue

- Document upload → 50-60% continue

- Selfie/liveness check → 40-50% continue

- Final approval → 20-50% successfully verified

Understanding where your specific users drop off is the first step toward fixing the problem.

Map and Measure Your Crypto KYC Funnel First

Optimization is impossible without precise analytics that show exactly where users abandon your kyc verification flow. You need visibility into device type, region, specific step, and time of day.

Start by tracking each discrete step in your verification process:

| Step | What to Measure |

|---|---|

| Account creation | Email/wallet connection success rate |

| Consent screen | Acceptance rate, time spent reading |

| Document upload | Success rate, retry rate, error types |

| Selfie capture | Success rate, liveness pass rate |

| Additional questionnaires | Completion rate, abandonment triggers |

| Final approval | Auto-approval vs manual review split |

Calculate step-level conversion rates to identify exactly where users drop. A 15% drop at document upload tells you something very different than a 15% drop at the selfie step.

Capture device-level metrics to spot technical issues. Compare iOS vs Android vs desktop performance. Track browser versions and OS types. Camera permission denials, slow uploads on older Android devices, and WebRTC compatibility issues are common culprits that create silent friction.

Use concrete measurement windows:

- 7-day completion cohorts show short-term friction

- 30-day completion cohorts reveal save-and-resume effectiveness

- Time-to-verify (median and 90th percentile) as a KPI tied directly to drop-off risk

Event analytics and session replay tools can reveal confusing UI elements that raw numbers miss. Heatmaps on document type selection screens often show users hesitating over unclear instructions or unfamiliar terminology.

Design Crypto-Specific, Risk-Based KYC Flows

Traditional bank-style KYC applies maximum verification to everyone from day one. Modern crypto KYC takes a different approach—adjusting verification depth based on risk level, jurisdiction, and usage pattern.

This risk based approach isn’t just good UX; it’s what regulators actually recommend. FATF guidance explicitly supports calibrating due diligence to the risk presented by each customer.

A tiered kyc verification structure might look like:

- Tier 0: Email or wallet connection plus basic info (name, country). Allows browsing, small crypto-only transactions, or demo functionality.

- Tier 1: ID document plus selfie verification. Unlocks standard trading limits and basic fiat on/off-ramps.

- Tier 2: Enhanced due diligence including proof of address, source of funds documentation, and PEP screening. Required for large volumes or high-risk regions.

This structure reduces friction for most users while maintaining compliance requirements for higher-risk activity.

Align your risk tiers with regulatory thresholds:

- EU MiCA rules define specific thresholds for enhanced verification

- FATF Travel Rule applies to transactions above certain values

- US FinCEN guidance allows for risk-based customer due diligence

- Internal policies can set even more granular triggers

Dynamic rules should escalate users to higher tiers only when specific triggers occur—cumulative volume thresholds, fiat on/off-ramp amounts, exposure to sanctioned wallet addresses, or transactions involving red-flag geographies.

Example scenario:

A user in Germany buying €150 of BTC with a debit card might only need Tier 1 verification (ID + selfie, completed in under 3 minutes). Meanwhile, a user in a higher-risk jurisdiction wiring $25,000 would face Tier 2 requirements including address verification, source of funds documentation, and potentially manual review.

Same platform, appropriately different flows.

Segment Users by Type, Region, and Use Case

Not all crypto users are alike, and your kyc processes shouldn’t treat them as if they are.

Design separate flows for distinct user segments:

- Retail traders: Standard individual KYC with ID and biometric verification

- Institutional clients: KYB (Know Your Business) with corporate documentation, beneficial ownership, and authorized representative verification

- DAOs and crypto-native entities: Flexible approaches that may involve multi-sig verification or alternative identity models

- Corporate treasury accounts: Full KYB plus enhanced controls

Regional segmentation is equally critical:

| Region | Common ID Types | Special Considerations |

|---|---|---|

| EEA | National IDs, passports, eIDs | GDPR data handling, MiCA compliance |

| US | Driver’s licenses, passports, state IDs | FinCEN requirements, state-by-state rules |

| APAC | e-KTPs (Indonesia), Aadhaar (India), MyNumber (Japan) | Varied regulatory maturity |

| LATAM | National IDs, CURP (Mexico), CPF (Brazil) | Document format variations |

Use-case-based routing adds another layer. Spot trading only might require lighter checks than derivatives and margin access. Staking could have different thresholds than NFT marketplace activity. Privacy-preserving asset transactions might trigger additional scrutiny under certain regulations.

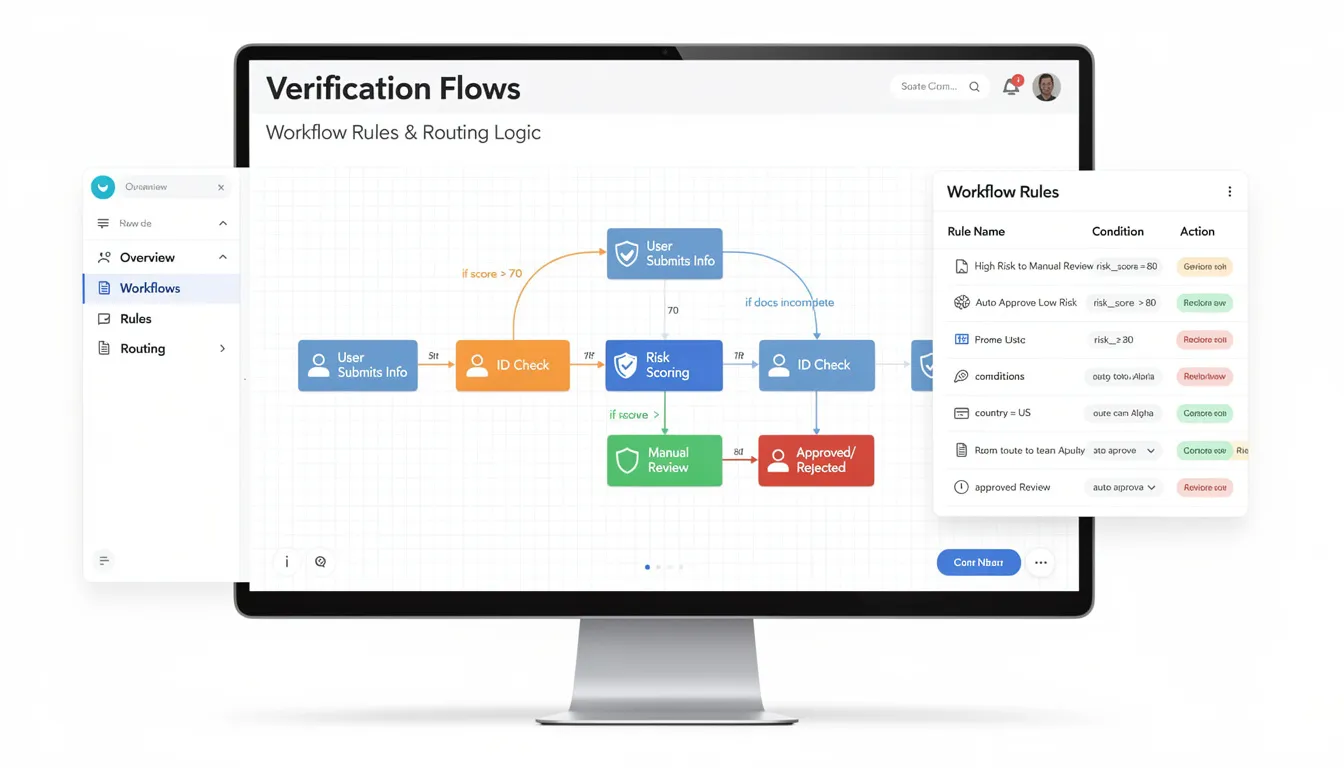

Auto-Route Users Using Risk and Fraud Signals

Passive fraud signals let you automatically route users into fast or enhanced verification flows without asking them additional questions upfront.

Key signals to incorporate:

- Device fingerprinting (known vs new devices, device reputation scores)

- IP reputation and geolocation analysis

- VPN and Tor detection

- Velocity checks (multiple accounts from same device/IP)

- Wallet screening for sanctions exposure or high-risk service interaction

Users flagged “green” (trusted devices, clean IPs, low intended volumes, no blockchain risk indicators) can move through a shortened flow—potentially ID-only verification without additional document capture steps.

Users flagged “amber” or “red” get routed to enhanced flows with extra steps like:

- Manual review queues

- Video verification calls

- Additional documentation requests

- Source of funds questionnaires

Modern orchestration tools and policy engines let compliance teams adjust routing thresholds in real time. When new fraud tactics emerge or regulations change, teams can modify risk scoring rules without requiring engineering deployments.

Third-party device intelligence providers and blockchain analytics services integrate via API, feeding signals into your decisioning engine automatically.

Embed and Streamline KYC Inside Your Crypto Product

Every redirect—from app to browser, from your platform to a third-party verification site—increases abandonment. For mobile-first crypto users, context switching is particularly deadly to completion rates.

Embed KYC natively using SDKs or web components that keep users inside your app throughout the entire verification process. Maintain consistent branding. Eliminate the jarring experience of being bounced to an unfamiliar domain.

Reduce form fields to the legal minimum:

- Auto-fill from wallet data where possible (e.g., email already verified)

- Pre-populate fields across steps (don’t ask for name twice)

- Skip optional fields unless required by specific risk triggers

Design for “one sitting” completion. Most new crypto users should be able to complete base-level kyc verification in under 3–5 minutes under normal network conditions. Anything longer and your abandonment rate climbs sharply.

Handle edge cases gracefully:

- Poor camera quality? Offer manual upload from photo gallery

- Slow network? Allow lower-resolution uploads with quality verification on backend

- Interrupted session? Send a link to continue later on desktop or another device

Optimize Mobile UX for Documents and Selfies

Mobile apps are where the majority of your crypto users will complete KYC. Your document capture experience makes or breaks completion rates.

Concrete UX improvements that reduce friction:

- Large, thumb-friendly buttons positioned at the bottom of the screen

- Clear instructions displayed above the camera viewfinder

- Real-time guidance (“Move closer”, “Reduce glare”, “Hold steady”)

- Auto-capture when the ID is properly positioned and in focus

Implement real-time image quality checks:

- Blurriness detection with instant feedback

- Glare identification before submission

- Edge detection to catch cut-off documents

- Expiration date OCR to flag outdated IDs immediately

Address camera permissions proactively. Display clear explanations before the permission prompt: “We only use your camera to verify your ID and selfie. No images are stored on your device.”

Permission denials are a major source of drop offs. A clear, non-threatening explanation before the system prompt significantly increases acceptance rates.

Support a wide range of document types across your key markets:

- Multiple languages for instructions and feedback (English, Spanish, Portuguese for Americas; German, French for EU; Hindi, Bahasa Indonesia for APAC)

- Region-specific ID examples so users know exactly which document to use

- Flexible format acceptance (vertical and horizontal orientations, different aspect ratios)

Use Transparent Progress Indicators, Status, and Save-and-Resume

Users informed about their progress are far more likely to complete verification than those left guessing.

Add visible progress bars with clear step counts: “Step 2 of 4” or “Document Upload → Selfie → Confirmation”

Display estimated time remaining based on your actual completion data. If most users finish the selfie step in 45 seconds, tell them.

Implement save-and-resume functionality:

- Allow users to pause on mobile and resume later

- Send magic links via email or SMS to continue from the same step

- Use in-app notifications to remind users of incomplete verifications

- Preserve all previously submitted data so nothing needs to be re-entered

Post-submission status updates are equally critical:

- “Verifying your ID – usually under 2 minutes”

- “Your selfie is being reviewed – you’ll hear back within 10 minutes”

- Proactive notifications if manual review is required

Communicating maximum expected waiting times (e.g., “Peak hours may take up to 10 minutes”) reduces anxiety and prevents users from abandoning before their verification completes.

Build Trust and Communicate Clearly Around KYC

Crypto users are especially sensitive to privacy, surveillance, and data breach risks. Research shows 57% of crypto users express concerns about how exchanges store their personal data, while 68% worry about potential breaches.

Clear communication directly impacts your completion rates.

Display these messages prominently near the start of your KYC flow:

- Why KYC is required: “Regulatory compliance and protecting you from fraud”

- What data is collected: “Government ID photo, selfie, and basic personal information”

- How it’s stored: “Encrypted at rest and in transit, deleted after X years”

- Who it’s shared with: “Only with regulators upon legal request; never sold to third parties”

Use plain, non-legal language. Link to detailed privacy policies for users engaged enough to read them. Mention relevant certifications (SOC 2, ISO 27001) when applicable—these matter to security-conscious users.

Add in-flow FAQs or tooltips addressing common crypto-user concerns:

- “Will this be reported to tax authorities?” (Answer honestly based on your jurisdiction)

- “Can I delete my data if I close my account?” (Explain retention requirements)

- “What happens if there’s a data breach?” (Describe your incident response)

Offer lightweight human support for users stuck during verification:

- Live chat widget within the KYC flow

- Clear email contact with expected response times

- 24/7 support if your user base spans multiple time zones

Response time is crucial. A user waiting for help during verification will abandon faster than one waiting for general support.

Localize Content and Expectations by Market

Localized KYC experiences reduce friction by meeting users where they are.

Translate all UI elements, not just the marketing pages. Include:

- Region-relevant examples (“Select your Personalausweis” in Germany, “Select your Aadhaar card” in India)

- Currency formatting that matches user expectations

- Date formats appropriate to the locale

Adapt messaging to local regulatory norms. European users understand eID systems and GDPR protections. Indian users may need reassurance about Aadhaar data handling. Japanese users expect formal, precise language.

Example comparison:

| Element | US User | Japanese User |

|---|---|---|

| ID prompt | “Upload your driver’s license or passport” | “Please provide your My Number Card or residence card” |

| Tone | Casual, direct | Formal, polite |

| Data message | “Your info is encrypted and secure” | “Your personal information is protected according to APPI regulations” |

Highlight regional support hours and local entities where relevant. Mentioning your EU VASP registration to European users or your FinCEN MSB status to US users increases credibility.

Control Costs and Drop-Off with Smart Workflow Orchestration

Over-verification drives both high abandonment and high vendor costs. Under-verification increases fraud risk and regulatory exposure. The goal is precisely calibrated verification.

Orchestration platforms help crypto teams build adaptive flows that respond to:

- Wallet size and transaction history

- Fiat on/off-ramp amounts

- Behavioral signals and suspicious activity indicators

- Geographic and regulatory requirements

Define custom pass/fail rules that you can tune over time:

- Selfie similarity score thresholds (e.g., 85% match vs 95% match)

- Document authenticity confidence levels

- Liveness detection sensitivity settings

- Sanctions screening match thresholds for false positives

Give compliance teams a no-code interface to modify rules when regulations change. New FATF guidance updates or expanded sanctions lists shouldn’t require engineering sprints.

Monitor the financial impact of your KYC configuration:

| Metric | What It Tells You |

|---|---|

| Cost per approved user | Total verification spend efficiency |

| Vendor fee by risk tier | Where you’re over-spending on low risk users |

| Manual review rate | Operations cost and delay impact |

| Fraud/chargeback rate by flow | Whether lighter flows are creating risk |

Using cheaper automated verification for low-risk cohorts while reserving expensive manual review for genuine edge cases optimizes both cost and conversion.

Integrate Blockchain and Off-Platform Risk Signals

Crypto platforms have unique risk data that traditional identity verification providers don’t natively understand.

Screen deposit addresses before escalating KYC requirements:

- Check for sanctions list exposure

- Flag addresses with darknet or mixer history

- Identify connections to high-risk services

- Detect patterns consistent with money laundering

Where regulations and user consent allow, re-use identity tokens or credentials across partner platforms. A user who completed KYC on your partner exchange shouldn’t need to re-upload documents to access your DeFi frontend.

Implement ongoing monitoring rather than front-loading every check:

- Standard verification at onboarding for most users

- Continuous monitoring of wallet behavior and transaction patterns

- Triggered enhanced verification when risk indicators emerge

Example scenario:

A user completes basic Tier 1 verification and trades small amounts for three months. When they attempt a $50,000 fiat withdrawal or receive funds from a flagged address, continuous monitoring triggers a Tier 2 upgrade request—source of funds documentation and additional review.

This approach reduces onboarding friction while maintaining regulatory compliance and fraud prevention effectiveness.

Continuously Test, Measure, and Iterate Your KYC Experience

Crypto markets shift quickly. New regulations emerge, user demographics evolve, and bull vs bear cycles change onboarding behavior. Your kyc processes must be iterative, not static.

Run A/B tests on specific elements:

- Step order: Selfie first vs ID first (some users find selfies less intimidating as a starting point)

- Explanation length: Minimal text vs detailed guidance

- Flow structure: Single-page form vs multi-step wizard

- Reminder strategies: Email timing, SMS inclusion, push notification copy

Monitor core KPIs monthly:

| KPI | Target Range | Action Trigger |

|---|---|---|

| Overall completion rate | 60-80% | Below 50% requires urgent review |

| Median time to complete | Under 3 minutes | Above 5 minutes indicates friction |

| Drop-off by step | Identify worst step | Any step with >20% drop needs optimization |

| Manual review percentage | Under 15% | Higher rates signal calibration issues |

| Fraud/chargeback rate | Industry baseline | Increases may indicate flow is too permissive |

Incorporate qualitative feedback:

- Short in-flow satisfaction prompts (“Was this verification easy?”)

- Review support tickets for recurring friction themes

- Monitor app store reviews mentioning KYC or verification

- Track social media complaints about your onboarding process

Establish a quarterly review ritual where compliance, product, and engineering teams analyze KYC performance together. Review the data, identify the top 2-3 friction points, and agree on specific optimizations for the next quarter.

This cross-functional approach ensures that reducing drop offs doesn’t come at the expense of staying compliant or managing fraud risk effectively.

FAQ

What is a “good” KYC completion rate for a crypto platform?

Completion rates vary significantly based on product type, jurisdiction mix, and risk appetite. Complex derivatives exchanges with global users might see 40–50% completion, while well-optimized consumer wallet apps can achieve 60–80%. What matters most is improvement over your own baseline. If you’re at 45% today, targeting 55% next quarter is more meaningful than comparing yourself to a different product category.

Can I relax KYC to reduce drop-off without breaking regulations?

You can’t ignore regulatory requirements, but you can implement them more intelligently. A risk based approach applies lighter checks to low-risk, low-volume users within legal thresholds while reserving enhanced due diligence for high-value or high-risk cases. This is explicitly what regulators like FATF recommend. The key is documenting your risk assessment methodology and ensuring your flows adapt when users cross defined thresholds.

How often should I update or re-verify existing users?

Re-KYC should primarily be trigger-based rather than arbitrary time-based. Major triggers include significant behavior changes, large new deposits, regulatory updates requiring additional data, or expired identity documents. Time-based re-verification (every 1–3 years) can supplement this but causes more churn when applied blanket-style. Consider tiering your re-verification requirements the same way you tier initial verification—low-risk users need less frequent review.

Do decentralized and non-custodial crypto apps need KYC?

Obligations vary by jurisdiction and by whether your app qualifies as a VASP or financial intermediary under local law. Many DeFi frontends are implementing KYC for specific features like fiat on-ramps even when not strictly required, either to access banking partners or to prepare for evolving regulations. Consult legal counsel familiar with crypto regulations in your target markets. The travel rule and expanding VASP definitions mean more protocols are coming into scope over time.

How long should crypto KYC take from a user’s perspective?

Target under 3–5 minutes for initial automated verification checks. Most manual reviews should complete within 10 minutes. Anything beyond these windows correlates strongly with abandonment. The average time across leading platforms has dropped to around 3.5 minutes, with top performers achieving sub-60-second verification for straightforward cases. If your median is above 5 minutes, prioritize reducing friction before adding new features.